Has anyone created a depreciation schedule in Tadabase to track depreciation of assets over a given period? I’m trying to decide how much to put in Tadabase and how much to do in Google Data Studio (once the connector is available).

-Henry

Has anyone created a depreciation schedule in Tadabase to track depreciation of assets over a given period? I’m trying to decide how much to put in Tadabase and how much to do in Google Data Studio (once the connector is available).

-Henry

Hi Henry, can you add some more details and example of what you would like to see and accomplish? What kind of data are you passing and what is the expected outcome? I think I might have an idea on how to achieve this, but first want to make sure I’m answering the right question.

Hi Moe,

We have a list of 500+ pieces of equipment, from vehicles to string trimmers, in a spreadsheet that I have converted to a table in Tadabase. We use flat-rate depreciation, which is mapped out in a spreadsheet (five years to depreciate to zero value) associated with many of these items. The depreciation is allocated per-month to our green season or white season (we do snow plowing in the winter and landscaping in the summer) based on a field that shows percentage for white (remainder for green). Green season is April thru October. White is November thru March.

I have not yet tried to put the depreciation numbers into Tadabase, because I’m not sure how I should do that. The goal is to be able to see equipment expense by month (and year) by branch and by equipment type for selected periods, also taking into account equipment that is purchased or sold (so the depreciation stops and we get the sale amount back as a reduction in cost).

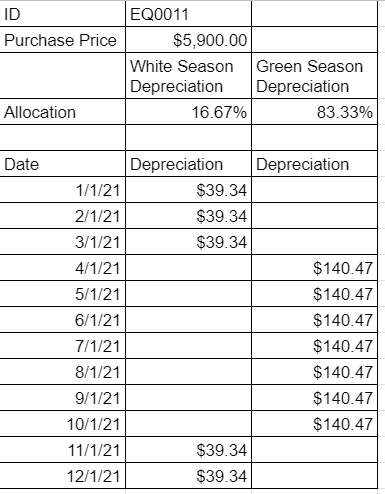

Here is a sample for one year for one piece of equipment:

I’m confident this is possible, but I don’t know enough about this topic to truly help.

If you have a script (PHP/Javascript or any language) that does this this would be likely very easily achievable.

As an example, suppose you want to output an amortization table without saving each record to the database. We have ways of doing that. You can see live example here: https://localtest.tadabase.io/mortgage-amortization#!/loans

If you can come up with the exact formula I’d be happy to help you further so you can generate the reports you want to see.

Moe,

This idea of generating a series of records from certain parameters is what I need. I don’t have a formula, but here’s what we need.

As in your example, we would need a depreciation term (years, usually 5), but we would always use 12 payments per year. In flat-rate depreciation, each payment would be the same amount.

For each season (there could be three or more “seasons”), there is a percentage of the purchase price (and the total of all seasons must be 100%), and we would need to generate a series of records for each season. In the example above, for the White season, 16.67% of the $5,900 purchase price is $983.53. Each season has a list of active months (always the same for that season), so White is active for months 1, 2, 3, 11, and 12, a total of five months. Five months times five years is 25 months, so each payment (for active months only) is $983.53 / 25 = $39.34.

If the purchase date is before the 16th, enter a full month’s depreciation; if not, start next month.

If and when the equipment is sold, we would need to fully depreciate the remaining months and credit the sale price.

So we would want to generate records something like this, with a series for each season.

Once the records are in the table, we could create reports as needed.

I hope that makes sense.

Thanks!

Henry

Moe,

I have added the input factors in my Asset Tracking program. The only thing I am missing is a way to create the array of individual depreciation records as described in my last reply above. Here is how it looks:

Thanks for claryfying, your explanation is super clear.

Without an external script I can’t really think of better way to do this. There are too many factors here to achieve this inside of a task.

You can email our team directly and we’ll see if we can help you with this. Doesn’t seem overly complex especially since you’ve already gotten the depreciation factors all sorted out.

Thanks, Moe! I’ll do that.

Hi Moe

I have a different problem, but am itrigued by this answer as it may give me some clues. But I don’t know HOW it works.

In my scenario I am trying to create a forward looking weekly workload schedule (looking out months in advance), based upon upcoming projects, their start date and duration. It needs to be dynamic (projects get delayed, or the duration changes) and so I really don’t want to separate create fields for each week. A dynamic view would be better … and I wonder if I might bend the example you shared to this purpose.

I think can see how you example could be bent to create the schedule for 1 project, although the real benefit will be shown if/when I can add multiples.

So … to my question. How did you do that? Is it explained somewhere ?

curious why do you need all the sub records.

I wonder could you calculate the “current depreciated value” on the fly

INPUTS:

Item Start Value = $130 on 1/Jan/21 (starting value)

Life span 5 years (60 months) let’s call it Y

So you want to know asset value on 30/Jun/21

Ue a formula calculate number of months between start date and 30/Jun/21 i.e. 6 lets call it Z

Depreciation to date = Item Start Value *(Z/Y)

Current Asset Value = Item Start Value - ( Item Start Value *(Z/Y) )

Any use ?

Regards

Noel

Hi ArthurBuy,

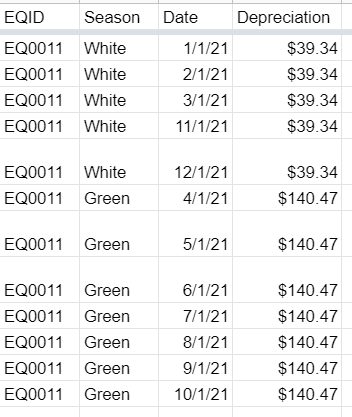

We want to be able to total up depreciation for selected periods sliced up in different ways, so it’s helpful to have the depreciation values in a table. I ended up taking a different approach, using a field for each depreciation month. Here’s a sample: